The Swiss franc (CHF) plays a key role in the global financial ecosystem. It is often seen as a safe-haven asset during times of economic turmoil. The Swiss National Bank (SNB) has made recent monetary policy adjustments, including two interest rate cuts this year. These changes highlight the unique economic landscape in Switzerland compared to the rest of Europe. This article explores the implications of these adjustments and the broader significance of the Swiss franc in today’s global economy.

The Swiss National Bank’s Policy Shifts

In an unexpected move, the SNB cut its key interest rates in March, a decision that caught many by surprise. This was followed by another rate cut last week, highlighting the bank’s proactive stance in managing the Swiss franc’s valuation. The SNB’s actions are influenced by multiple factors, including the need to maintain a degree of control over the currency and to mitigate the effects of external economic pressures, particularly from the eurozone.

The Safe-Haven Currency

The Swiss franc has long been associated with stability. In times of global economic distress, investors flock to CHF much like they would to gold. This trend has been evident in recent months, as geopolitical tensions, particularly the ongoing conflict in Ukraine, have driven investors towards safer assets. The franc’s appreciation since its lows in May is a testament to this behavior.

Euro-Franc Parity: Economic Implications

Interestingly, the SNB has downplayed the economic significance of the Swiss franc rising above parity with the euro. Chairman Thomas Jordan, in a recent interview with Swiss radio station SRF, stated that while the exchange rate is an important metric, it is not the sole determinant of the SNB’s policies. The central bank considers a broad range of currencies and the relative inflation rates. Despite the franc’s surge, Swiss businesses have managed to adapt well, showcasing the resilience of the Swiss economy.

Inflation and Monetary Policy

Switzerland has seen its inflation rate climb to 2.2%, the highest since 2008. However, this is still modest compared to the soaring inflation rates in the United States and Europe. The SNB has maintained its expansive monetary policy, keeping interest rates at a historically low -0.75%. This approach reflects a careful balance between curbing inflation and preventing the franc from appreciating excessively.

The Future of the Swiss Franc

The SNB’s commitment to monitoring inflation and exchange rate developments closely indicates a readiness to intervene in the currency markets if necessary. This vigilance is crucial in maintaining the franc’s stability and ensuring the Swiss economy remains insulated from external shocks.

Moreover, the Swiss experiment with central bank digital currencies (CBDCs) adds another layer to the currency’s evolving narrative. As the SNB explores the potential of digital currencies, it aims to stay ahead of the curve in financial innovation, which could further enhance the franc’s role in global finance.

Conclusion

The Swiss franc continues to serve as a bastion of financial stability amidst a volatile global economic landscape. The strategic implementation of low interest rates by the Swiss National Bank (SNB) reflects Switzerland’s unique macroeconomic conditions. As geopolitical uncertainties persist and inflationary pressures diverge across regions, the franc’s status as a safe-haven asset will likely endure. Both investors and policymakers will undoubtedly maintain a close watch on the SNB’s monetary policy actions and the franc’s performance as they navigate the complexities of the current global economic environment.

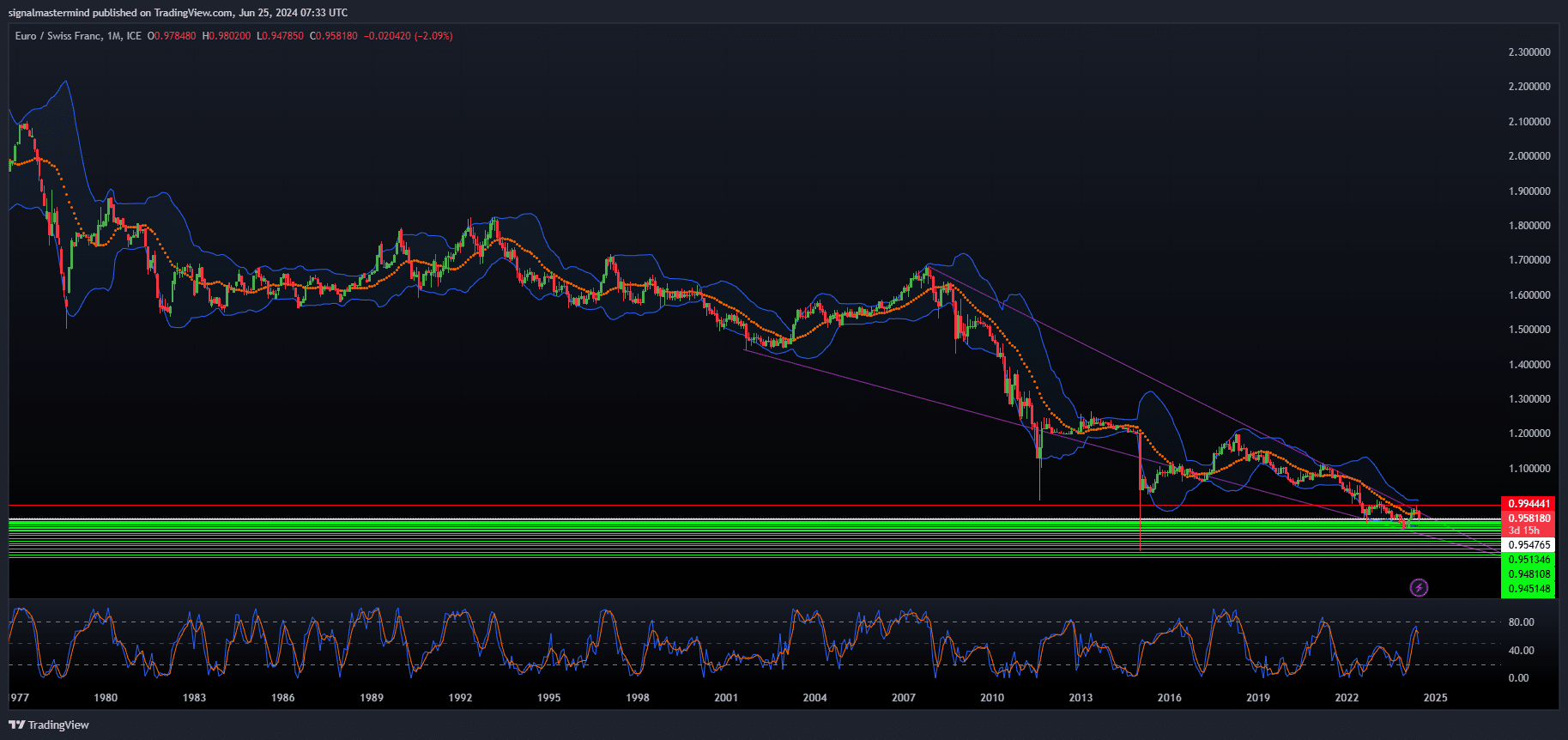

EUR/CHF Short (Sell)

Enter At: 0.954765

T.P_1: 0.951346

T.P_2: 0.948108

T.P_3: 0.945148

T.P_4: 0.942904

T.P_5: 0.939839

T.P_6: 0.935424

T.P_7: 0.931256

T.P_8: 0.927436

T.P_9: 0.923138

T.P_10: 0.919466

T.P_11: 0.913124

T.P_12: 0.907686

T.P_13: 0.898103

T.P_14: 0.890912

T.P_15: 0.882748

T.P_16: 0.877189

T.P_17: 0.868729

T.P_18: 0.859217

T.P_19: 0.850036

T.P_20: 0.843229

S.L: 0.994441

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.