Recent stock market surges, with major indexes scaling unprecedented highs, have painted a rosy picture. However, some financial experts caution that a substantial correction could be imminent. This analysis delves into the arguments for a potential crash, explores reasons for optimism, and presents risk mitigation strategies for investors.

Bearish Outlooks

- Valuation Concerns: Paul Dietrich, Chief Investment Strategist at B. Riley Wealth Management, emphasizes a looming crash driven by inflated valuations. He highlights the significant discrepancy between current stock prices and underlying corporate fundamentals, suggesting a correction is necessary to restore equilibrium.

- Historical Precedents: Dietrich cites historical trends during recessions, where the S&P 500 typically experiences substantial declines. He posits a similar scenario, predicting a potential plunge of 44% for the index.

- Flash Crash Potential: JPMorgan Chase strategists warn of a “flash crash,” a sudden and severe market downturn triggered by a rapid sell-off. They point to the possibility of a domino effect, where repositioning by a critical mass of fund managers could snowball into widespread panic selling.

- Tech Stock Concentration: Goldman Sachs strategists acknowledge a more moderate year-end decline for the S&P 500. However, they raise concerns about the market’s heavy concentration in technology stocks. An overvalued tech sector could exacerbate a broader market selloff.

Reasons for Measured Optimism

- Market Resilience* Despite past predictions of imminent crashes, the stock market has exhibited remarkable resilience. This historical trend suggests that the current bull run may persist longer than anticipated.

- Dollar-Cost Averaging: This long-term investment strategy advocates for consistent investments at regular intervals, regardless of market conditions. By doing so, investors can benefit from averaging out entry points over time.

- Focus on Fundamentals: Some investment philosophies prioritize a focus on company fundamentals, emphasizing in-depth analysis of a company’s financial health and long-term prospects over short-term market fluctuations.

Risk Mitigation Strategies

- Portfolio Diversification: Diversification across asset classes, such as stocks, bonds, and real estate, helps mitigate market downturns and reduces vulnerability to sector-specific declines.

- Long-Term Investment Horizon: Investors with a long-term perspective can potentially weather market volatility. Historically, stock markets tend to recover from downturns over extended periods.

- Risk Tolerance Assessment: Understanding individual risk tolerance is crucial. Investors with a lower risk appetite may want to adjust their asset allocation towards more conservative options.

Conclusion

The future trajectory of the stock market remains uncertain. While compelling arguments exist for a potential crash, there are also reasons to maintain a cautiously optimistic outlook. By carefully considering the various perspectives, potential risks, and risk mitigation strategies, investors can make informed decisions to safeguard their portfolios.

Additional Considerations

- The Federal Reserve’s monetary policy decisions significantly impact the stock market. Closely monitoring these pronouncements can provide valuable insights into potential market movements.

- Geopolitical events can also trigger market volatility. Staying informed about global developments and potential flashpoints can help investors anticipate potential risks.

- Investors can make informed decisions by monitoring economic data and trends and adapting their investment strategies accordingly.

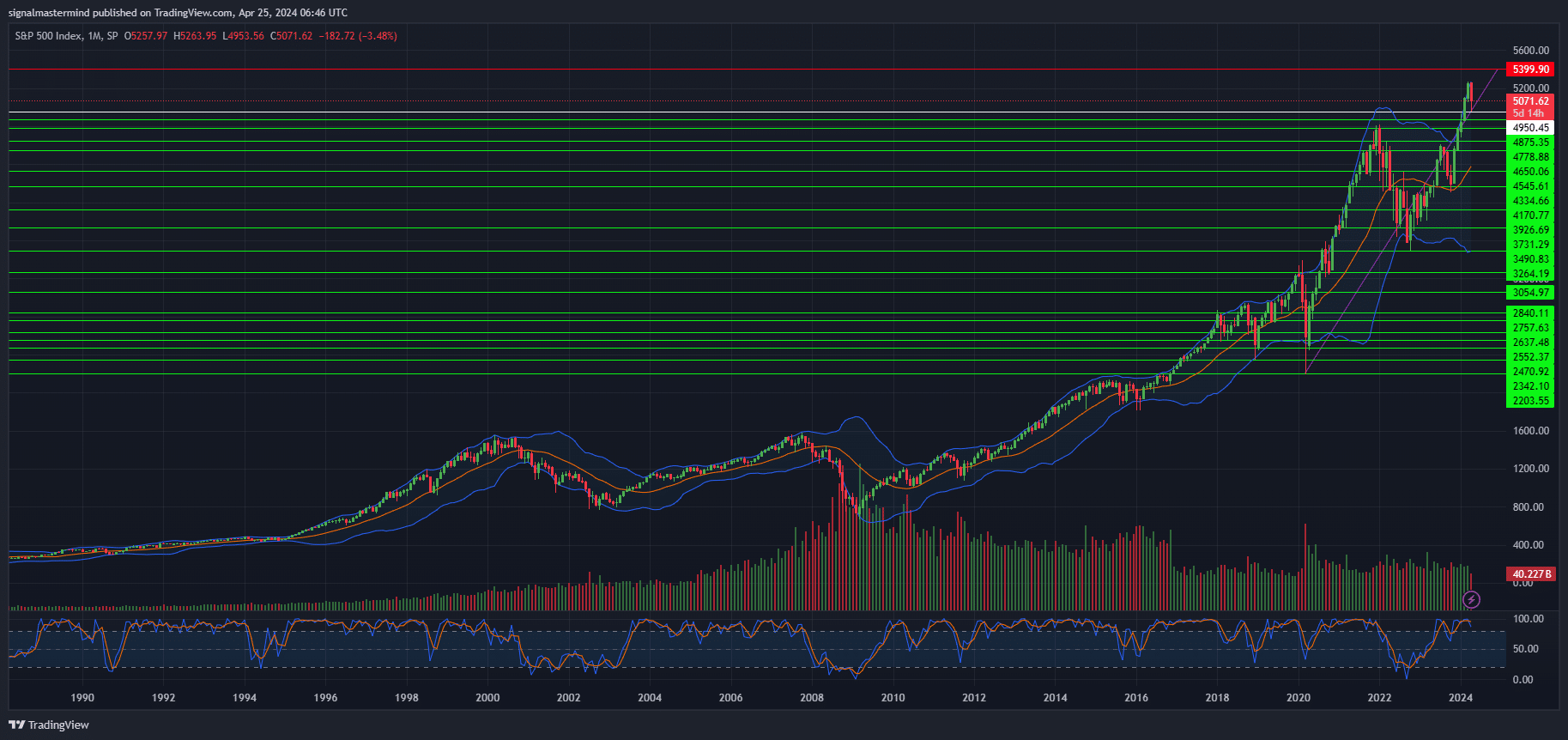

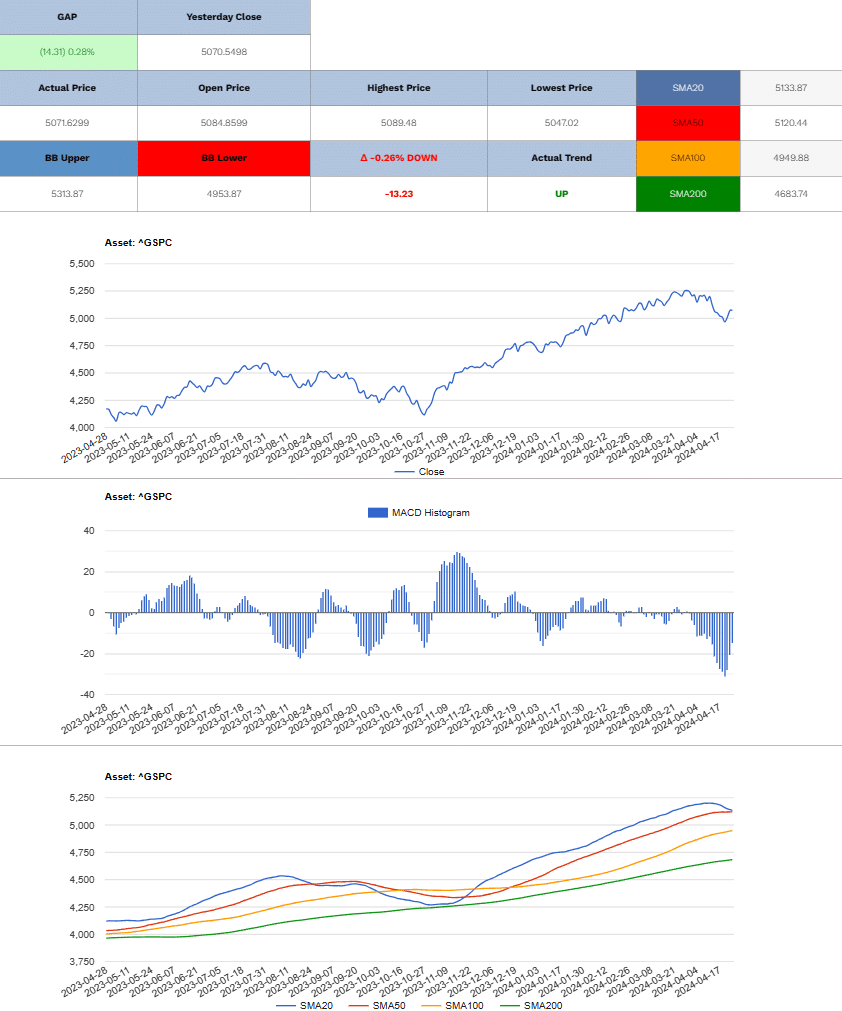

S&P 500 Short (Sell)

Enter At: 4950.45

T.P_1: 4875.35

T.P_2: 4778.88

T.P_3: 4650.06

T.P_4: 4545.61

T.P_5: 4334.66

T.P_6: 4170.77

T.P_7: 3926.69

T.P_8: 3731.29

T.P_9: 3490.83

T.P_10: 3264.19

T.P_11: 3054.97

T.P_12: 2840.11

T.P_13: 2757.63

T.P_14: 2637.48

T.P_15: 2552.37

T.P_16: 2470.92

T.P_17: 2342.10

T.P_18: 2203.55

S.L: 5399.90

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.