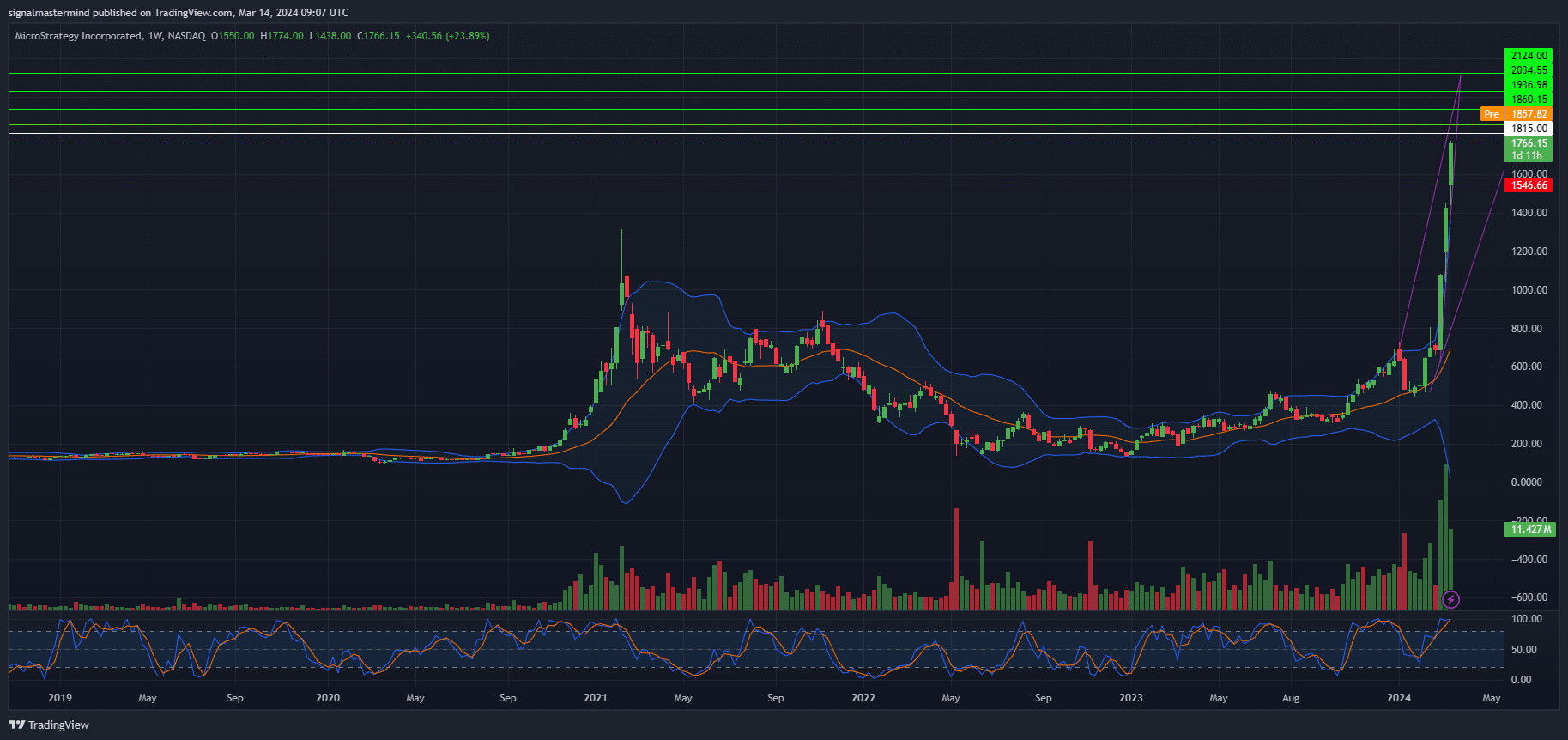

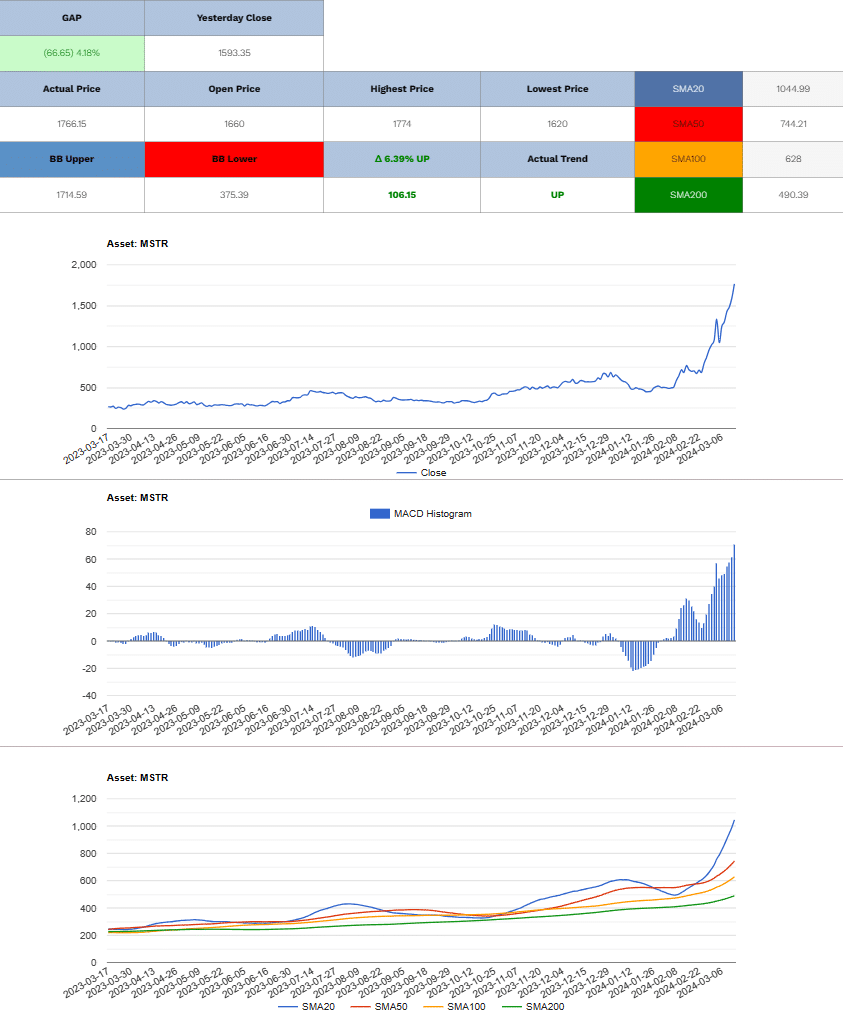

MicroStrategy Inc. has witnessed a meteoric rise in its stock price this year, mirroring the record-breaking surge in Bitcoin (BTC). This upward trajectory has inflicted substantial losses on short sellers who had positioned themselves for a decline in the company’s share price.

Short Sellers Face Mounting Losses:

- Data from S3 Partners LLC reveals that short sellers have incurred significant paper losses exceeding $3.3 billion in 2024 alone, owing to the stock’s over 170% gain.

- Combined with losses from the preceding year, the cumulative total surpasses a staggering $4.3 billion.

Potential Short Squeeze on the Horizon:

- Analysts warn that short sellers might endure further financial strain. A sustained uptrend in MicroStrategy’s share price could trigger a short squeeze.

- In a short squeeze scenario, short sellers are compelled to repurchase stock to cover their losing positions, inadvertently pushing the price even higher and exacerbating their losses.

Bitcoin Acquisitions Fuel Stock Rally:

- MicroStrategy’s aggressive Bitcoin buying strategy has been a fundamental catalyst for the stock’s recent surge.

- This week, the company significantly expanded its Bitcoin holdings by nearly $822 million, primarily funded by selling convertible notes.

- Bitcoin recently established a new all-time high exceeding $73,000, driven in part by the introduction of novel Bitcoin-linked exchange-traded funds (ETFs).

Analyst Community Expresses Bullish Sentiment:

- Wall Street analysts have exhibited a decidedly bullish outlook on MicroStrategy, reflected in their upward revisions of the company’s price targets.

- Canaccord Genuity leads the pack with the most optimistic target of $1,810, a significant increase from their previous target of $975.

- Most analysts consider MicroStrategy’s Bitcoin holdings a long-term investment and recommend the stock for investors interested in the cryptocurrency market.

Key Points:

- MicroStrategy’s stock price has exhibited exceptional growth, directly correlated with the rise of Bitcoin.

- Short sellers have sustained substantial financial losses.

- The potential for a short squeeze looms large, potentially further amplifying the stock’s gains.

- Analysts hold a positive outlook on MicroStrategy’s future trajectory due to its strategic focus on Bitcoin.

MicroStrategy Long (Buy)

Enter At: 1815.00

T.P_1: 1860.15

T.P_2: 1936.98

T.P_3: 2034.55

T.P_4: 2124.00

S.L: 1546.66

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.