Meta Platforms Inc. experienced a tumultuous post-earnings session on Wednesday, despite exceeding both profit and revenue expectations for the first quarter of 2024. The company’s stock price plunged by 19% in after-hours trading, reflecting investor unease over the substantial financial resources being allocated towards the nascent metaverse and artificial intelligence (AI) initiatives.

Focus on Metaverse Raises Concerns

The primary driver of investor trepidation appears to be Meta’s aggressive investment in Reality Labs, the division spearheading the development of the metaverse. While CEO Mark Zuckerberg emphasized a “multiyear investment cycle” similar to past successful ventures, Reality Labs reported a staggering $3.85 billion loss in Q1, bringing its cumulative losses since 2020 to a concerning $45 billion. The lack of a clear path to profitability for these metaverse projects has shaken investor confidence in the short term. Further compounding the issue was Meta’s light revenue forecast for the second quarter, casting a shadow over the positive Q1 results.

Tech Sector Feels the Chill

The ramifications of Meta’s earnings call extended beyond the company itself. The broader technology sector witnessed a ripple effect, with major players like Alphabet (Google’s parent company), Microsoft, and Amazon experiencing significant stock price declines. This suggests that investors are approaching upcoming earnings reports with heightened caution, apprehensive about potential disappointments within the tech industry.

AI: A Promising Future, or a Costly Gamble?

Zuckerberg’s emphasis on AI advancements during the call, including the unveiling of Meta Llama 3 and their response to ChatGPT, added another layer of complexity. While these innovations hold promise for the future, investors remain uncertain about the timeline and efficacy of monetizing these AI investments.

Balancing Long-Term Vision with Short-Term Needs

Meta’s current predicament highlights the inherent tension between pursuing a transformative long-term vision and delivering consistent financial performance in the short term. Zuckerberg’s unwavering commitment to the metaverse and AI represents a bold strategic move, but it necessitates a delicate balancing act. Meta must demonstrate a clear roadmap towards monetization of these ventures to regain investor confidence and ensure the sustainability of its ambitious future endeavors.

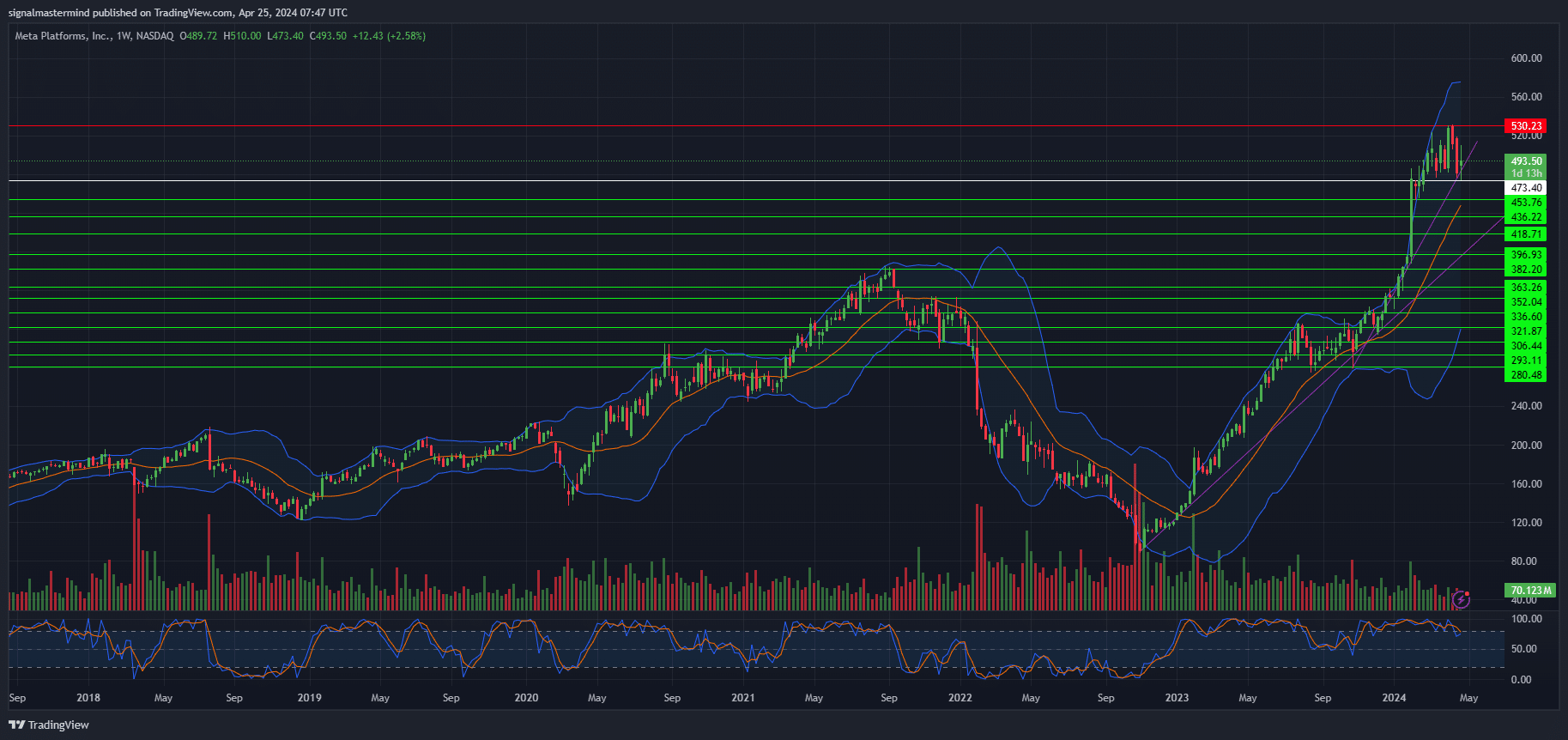

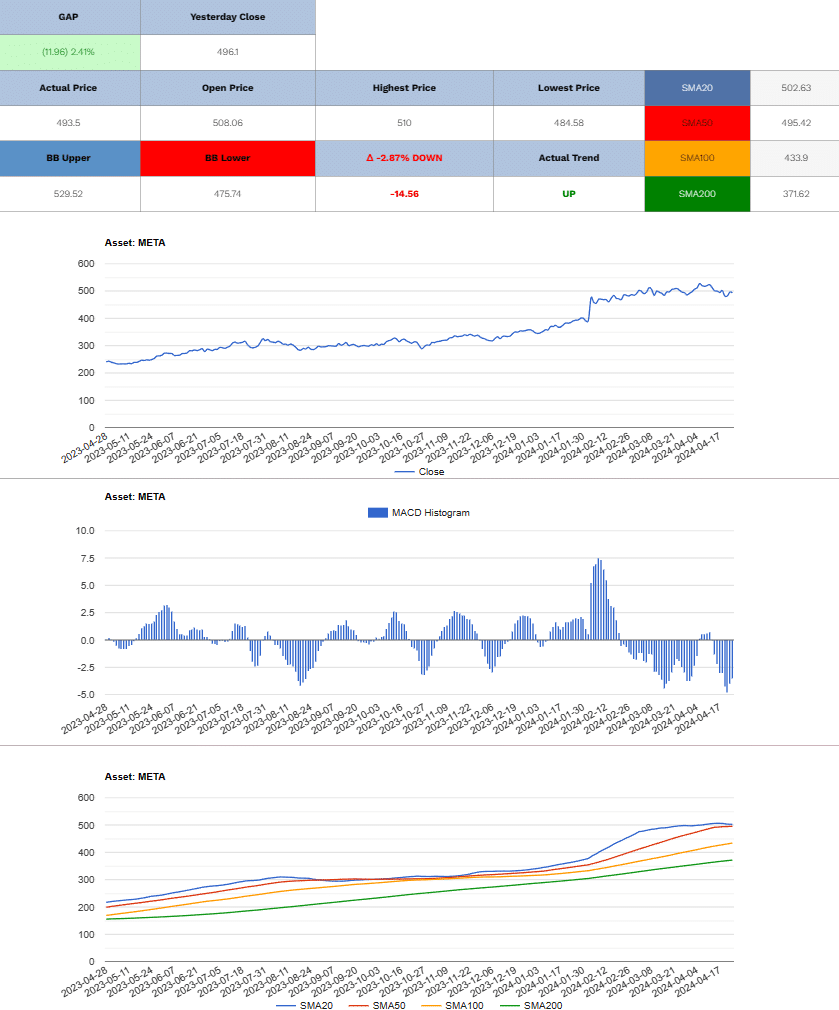

Meta Short (Sell)

Enter At: 473.40

T.P_1: 453.76

T.P_2: 436.22

T.P_3: 418.71

T.P_4: 396.93

T.P_5: 382.20

T.P_6: 363.26

T.P_7: 352.04

T.P_8: 336.60

T.P_9: 321.87

T.P_10: 306.44

T.P_11: 293.11

T.P_12: 280.48

S.L: 530.23

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.