The lean hog market is exhibiting robust bullish momentum, defying expectations set by the recent USDA Hogs and Pigs Inventory Report. This report projected sow herd expansion, typically a bearish indicator. This article dissects the key drivers behind this price surge and explores the potential trajectory of the market in the coming months.

Market Dynamics:

- Robust Demand: Despite USDA data suggesting increased hog production, demand for pork remains robust. This is evidenced by the National Negotiated Lean Hog price reaching a one-year high last Friday. Additionally, pork cut-out values surpassed $100 per pound for the first time since September 2023, indicating a strong consumer offtake.

- Contractionary Global Supplies: China’s ongoing sow herd liquidation is anticipated to result in significantly reduced global hog supplies later this year. This impending supply shortage is likely a major factor propelling the current price appreciation in the lean hog market.

- Feed Cost Considerations: While corn prices experienced a recent dip following a USDA report indicating reduced planting acreage, they remain a significant cost factor for hog producers. The lack of government support programs for the pork industry, compared to the established programs for the corn-soybean complex, is a point of contention within the industry.

Canadian Hog Production:

- Downward Revision: A recent USDA GAIN report revised Canadian pork production forecasts downward for 2024. This revision is attributed to heavier carcass weights and processing limitations in Eastern Canada.

- Sow Herd Dynamics: The Canadian sow herd is experiencing a decline, particularly in Eastern Canada. However, Western Canada witnessed a slight increase despite processing cutbacks by Olymel, a major pork processor.

Global Disease Outbreak:

Japanese Encephalitis Virus: An outbreak of this mosquito-borne disease impacted Australian piggeries in 2022, leading to substantial production losses. The industry’s successful response to this foreign animal disease episode underscores the importance of robust biosecurity protocols and preparedness plans.

Market Outlook:

The lean hog market is positioned for continued upward movement in the near term, driven by robust demand and anticipated supply constraints arising from China’s sow herd liquidation. However, feed costs remain a potential headwind for producers. Close monitoring of global supply dynamics and evolving consumer demand patterns will be crucial for informed decision-making in the lean hog market.

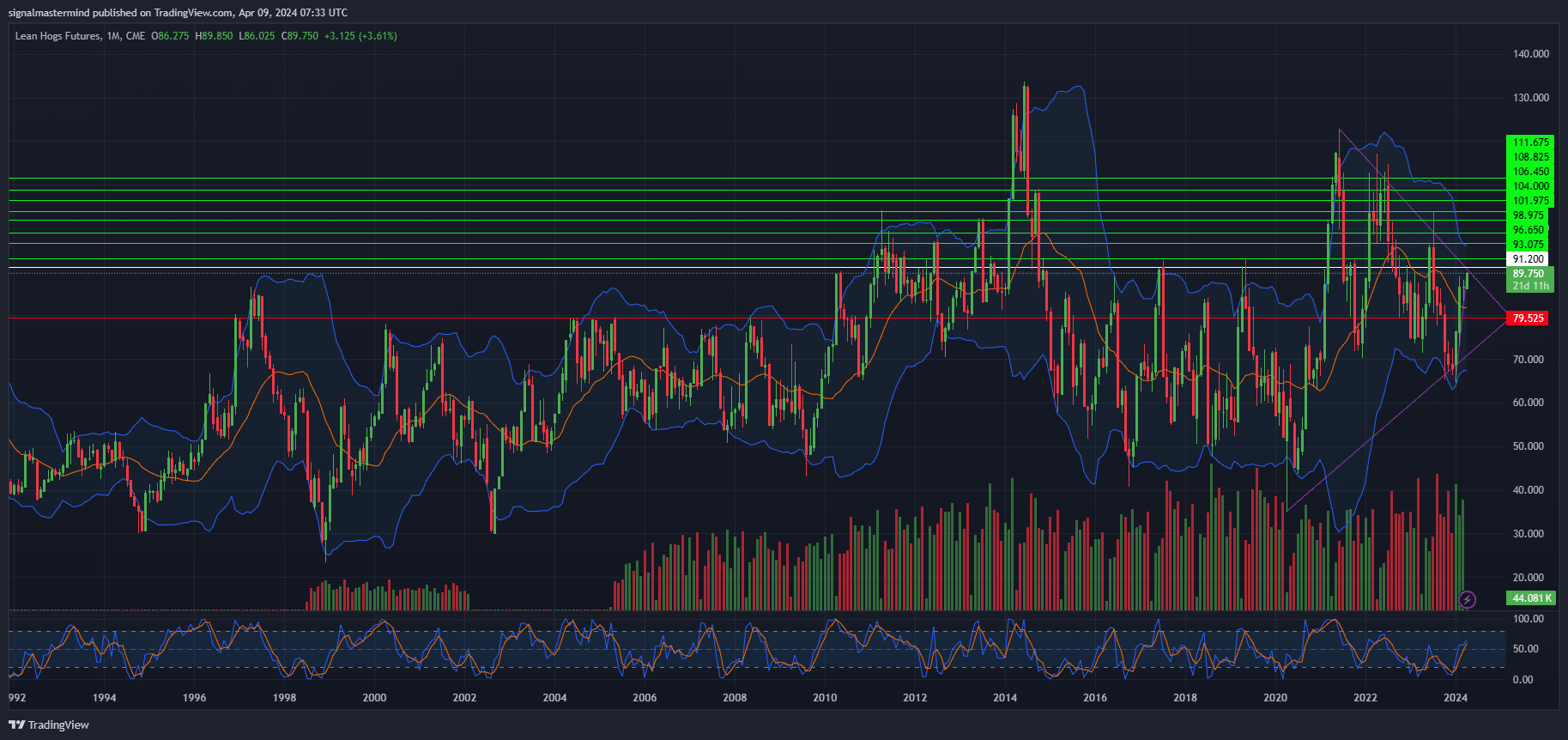

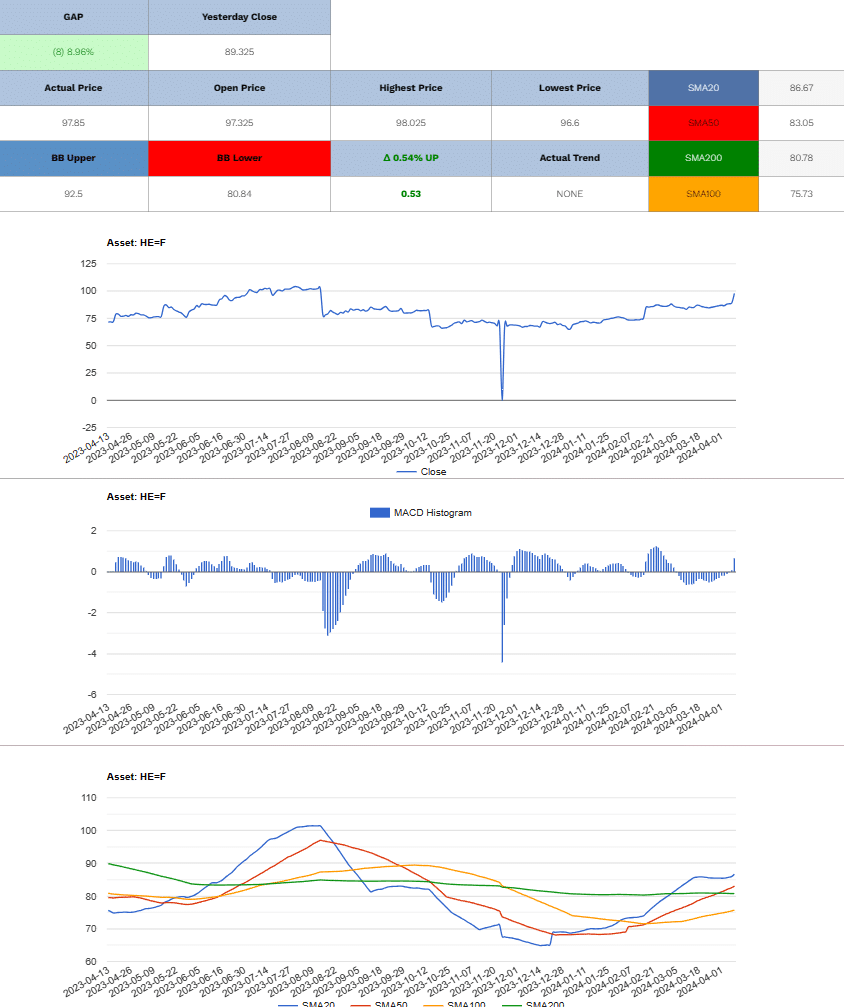

Lean Hog Long (Buy)

Enter At: 91.200

T.P_1: 93.075

T.P_2: 96.650

T.P_3: 98.975

T.P_4: 101.975

T.P_5: 104.000

T.P_6: 106.450

T.P_7: 108.825

T.P_8: 111.675

S.L: 79.525

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.