Gold prices continued their record-breaking rally on Monday, buoyed by speculative buying and ongoing tensions in the Middle East. These factors overshadowed strong U.S. job growth in March. Analyst Kyle Rodda (Capital.com) says futures prices show investors are chasing momentum and overly optimistic about gold at current levels.

Geopolitical tensions in the Middle East could be another driving force for gold, according to Rodda. Bullion’s 12% gain for the year so far has been fueled by strong central bank buying, safe-haven inflows amid elevated geopolitical risks, and demand from momentum-following funds.

Despite U.S. job growth exceeding expectations in March, which suggests the economy ended the first quarter on solid ground, this may delay anticipated Federal Reserve interest rate cuts this year. That said, lower interest rates reduce the opportunity cost of holding bullion.

According to senior analyst Matt Simpson from City Index, the market seems inclined to test $2,400. He believes that there is no sign of a top forming, which means it might reach that level. However, he does foresee some bearish volatility at some point, which could lead to some bulls being shaken out from these highs. The higher the market goes, the more attractive it becomes for some larger players to make profits.

On the physical side, gold demand in India remained tepid last week due to the blistering rally in domestic prices that put off buyers. Meanwhile, premiums held firm in top consumer China.

The Latest Investment Frenzy in China has Caused Wild Swings in the Gold ETF.

Chinese investors rush to buy an ETF that invests in gold companies, seeing it as a Safe Haven amid economic challenges. The ChinaAMC CSI SH-SZ-HK Gold Industry Equity ETF became a target of frenzied trading, halting trading twice since last Tuesday. Trading for the ETF stopped until 10:30 a.m. to protect investors’ interests. Monday local time to protect investors’ interests. The ETF’s premium over its underlying assets reached more than 30%, the highest on record, as of April 3. This came after the ETF’s price had gained more than 40% in the past four sessions. It fell by 10% after trading resumed on Monday.

Investors in China are attracted to sectors with market strength, such as gold, as property woes, volatile stocks, and falling deposit rates reduce their options. The ETF fervor is a fresh example of yield-hungry Chinese investors flocking to pockets of market strength. They see gold as a sector that is relatively immune to a struggling economy. In recent weeks, gold has staged a record-setting rally, reaching an all-time high, due to expectations of US interest rate cuts and rising geopolitical tensions. China’s central bank is also a big buyer, having purchased the precious metal for its reserves for the 17th straight month in March.

Shares of Chinese gold miners have also produced stellar gains this year. Zijin Mining Group Co. and Shandong Gold Mining Co. have both risen more than 50% from their respective lows earlier in the year. The two stocks have entered overbought territory based on technical indicators.

Chinese investors’ recent frenzy over a gold ETF echoes their earlier buying spree of overseas stocks. This year’s local stock market slump drove them to onshore funds investing in foreign stocks. In one case, investors pushed the premium on a Japan equity ETF (also by China Asset Management) above 10%, triggering a warning.

China Asset Management, which sells the gold ETF, has added China Galaxy Securities Co. as a liquidity provider for the ETF. Bloomberg Intelligence analyst Rebecca Sin said, “Gold is trading at an all-time high, and gold ETF demand has surged in the past week with almost $600 million of net inflows into gold ETFs globally. Demand in Mainland China could continue as investors look to diversify their holdings with commodities and foreign ETFs.”

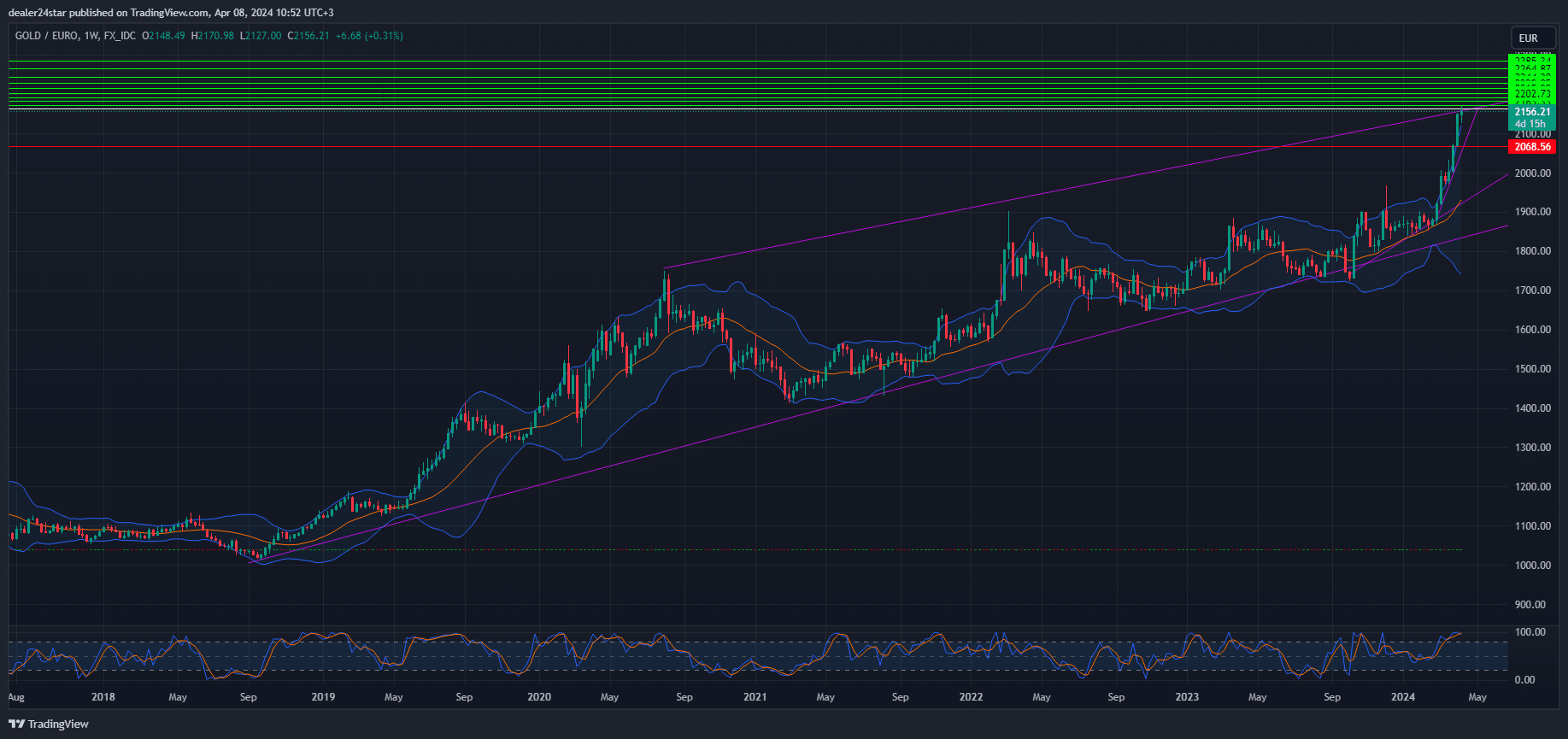

XAU/EUR Long (Buy)

Enter At: 2163.44

T.P_1: 2172.75

T.P_2: 2183.33

T.P_3: 2192.13

T.P_4: 2202.73

T.P_5: 2215.99

T.P_6: 2229.05

T.P_7: 2244.30

T.P_8: 2264.87

T.P_9: 2285.34

S.L: 2068.56

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.