The copper market currently finds itself at a crossroads. Recent price surges, reaching a 22-month high near $10,000 per ton, have ignited a debate amongst industry experts regarding the underlying sustainability of this rally.

Architects of the bullish narrative, such as Goldman Sachs’ Nick Snowdon, foresee this as the nascent stages of a long-anticipated bull market. Their projections depict a staggering $15,000 per ton price point for next year, citing a confluence of factors. These include a constricting supply chain, particularly for semi-processed copper concentrate, and an upswing in demand driven by the green energy transition and burgeoning technological advancements like artificial intelligence and automation.

However, dissenting voices, exemplified by Macquarie Group’s Alice Fox, caution against premature exuberance. Their analysis suggests that current price levels lack fundamental justification, pointing to lackluster demand indicators in China, the world’s top copper consumer. Even within Chile, the world’s leading copper producer, some miners, and traders, though incentivized by higher prices, express reservations.

One undeniable wrinkle in the market concerns the aforementioned concentrate market. Smelters are currently engaged in bidding wars for this raw material, driving its price to unsustainable levels. While this situation cannot persist indefinitely, it has the potential to trigger smelter cutbacks, ultimately leading to a genuine metal shortage later. The upcoming annual supply deal negotiations between miners and smelters will be a critical juncture in this regard.

The long-term outlook for copper prices appears more settled, with a majority of experts predicting an upward trajectory. Shortages and robust demand from the electric vehicle and renewable energy sectors are expected to be the primary drivers.

Key Points:

- Copper prices have surged to near two-year highs due to potential supply constraints and bullish demand projections.

- The industry is grappling with divergent views, with some predicting a sustained bull market and others anticipating a correction.

- The current tightness in the concentrate market holds the potential for future metal shortages.

- The green energy transition and technological innovations are poised to be long-term catalysts for copper demand.

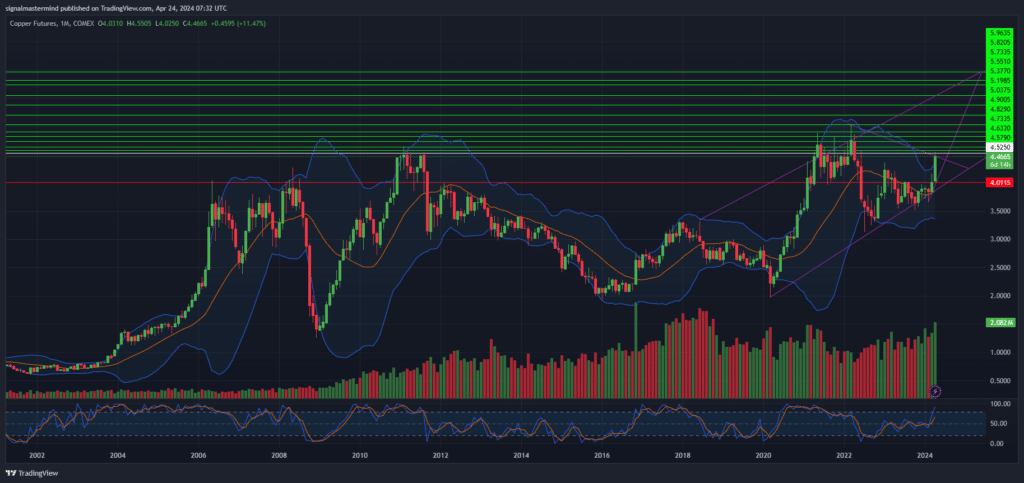

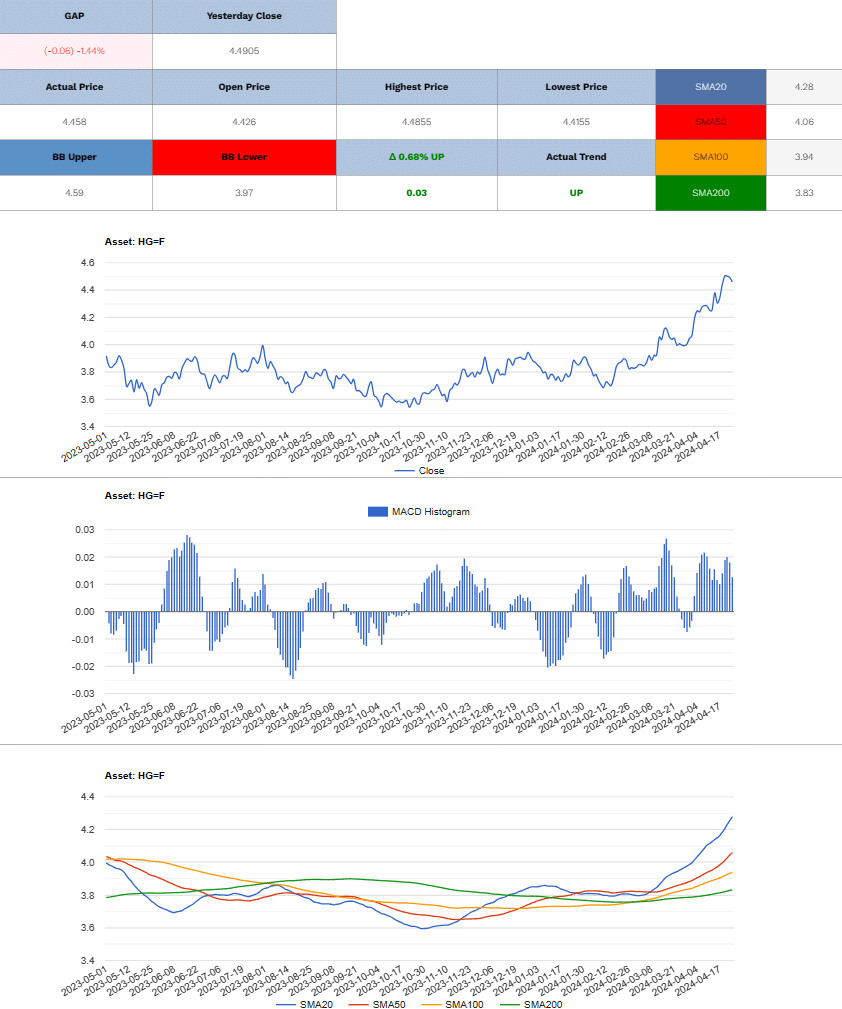

Copper Long (Buy)

Enter At: 4.5250

T.P_1: 4.5790

T.P_2: 4.6330

T.P_3: 4.7335

T.P_4: 4.8290

T.P_5: 4.9005

T.P_6: 5.0375

T.P_7: 5.1985

T.P_8: 5.3770

T.P_9: 5.5510

T.P_10: 5.7335

T.P_11: 5.8205

T.P_12: 5.9635

S.L: 4.0115

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.