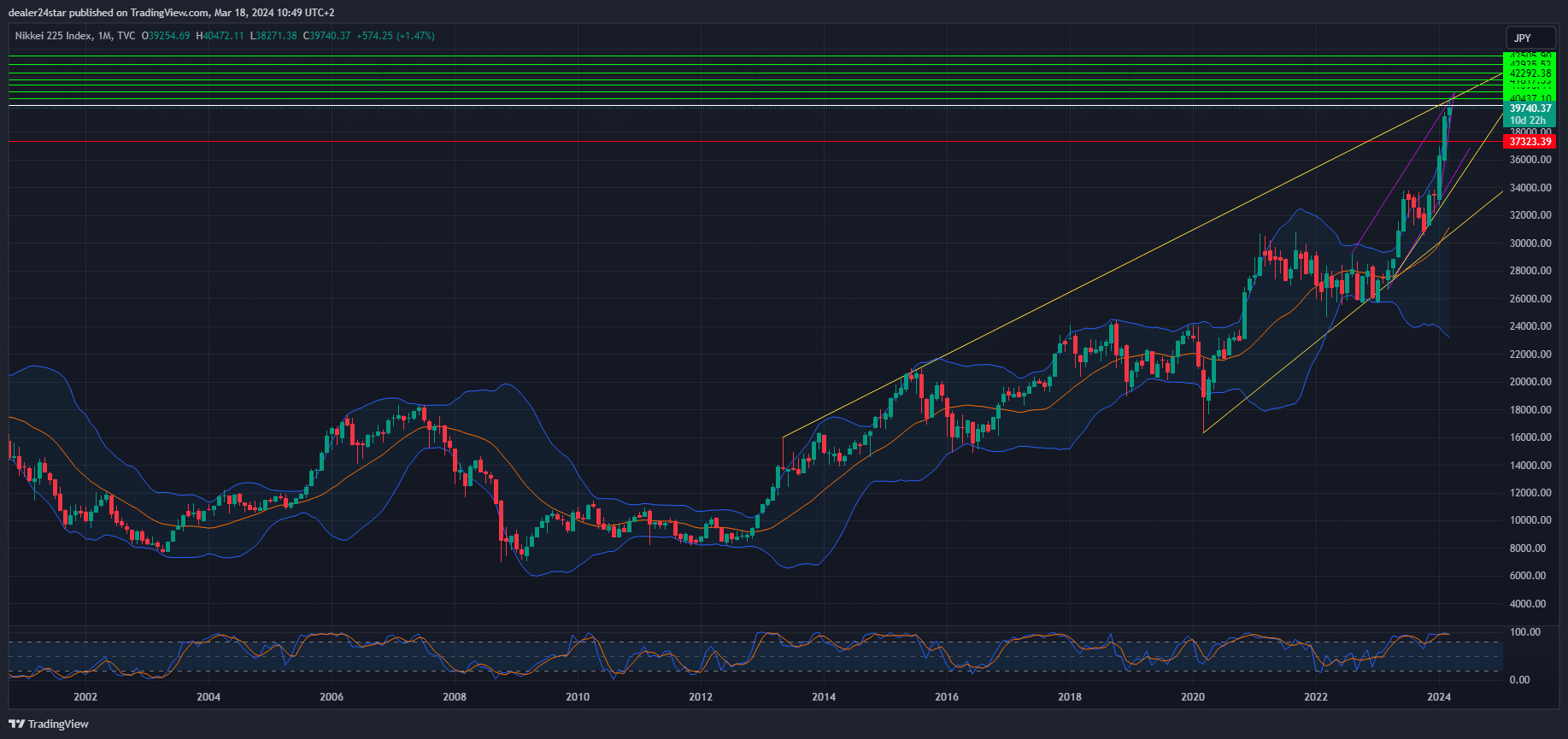

The MSCI Asia Pacific Index saw a rise, thanks to the outperformance of Japanese equities. The Nikkei 225 index experienced the most significant increase in a month as speculations mounted that the Bank of Japan would put an end to its negative-rate policy on Tuesday. The yen was weaker against the dollar, contributing to the rise of Japanese stocks.

Charu Chanana, a strategist at Saxo Capital Markets based in Singapore, noted that Japanese stocks are on the rise due to the weakening of the yen and the expectation that the currency won’t strengthen even if the central bank hikes. According to Chanana, the focus is much more on Nvidia and the Fed this week, although the BOJ is all priced in.

Equities in China rallied, thanks to surprisingly strong economic numbers that provided further evidence of more traction for the world’s second-largest economy. However, the data is unlikely to push the yuan out of its recent tight range as the currency is torn between China’s central bank and the upcoming Federal Reserve policy meeting.

Commonwealth Bank of Australia suggests that “A potentially hawkish FOMC meeting can place upward pressure on dollar-offshore yuan” this week, but that “will likely be capped by the People’s Bank of China’s continued onshore yuan support at the daily fix.”

The direction of global stocks for the next quarter may depend on the outcome of the Fed’s policy meeting on Wednesday. Before the blackout period, Chairman Jerome Powell indicated the central bank was close to having the confidence to cut, while others debated how deep or shallow those declines would be.

BOJ’s Impact on Japan’s Foreign Investments

“Japan’s investors continue to seek higher returns by investing abroad, undeterred by the Bank of Japan’s efforts to stimulAnalysts say that despite the Bank of Japan preparing for a significant change in monetary policy, much more will be needed to materially shift the roughly $3 trillion of yen that Japanese investors have invested in global bond markets and yen trades.

Japanese investors have invested trillions of yen overseas to earn better returns than the near-zero returns available at home under the BOJ’s decades-long effort to end deflation.

The BOJ may change that policy as soon as this week. Rising wages and other business activity suggest stagnation is over, which means there is little need for the BOJ to continue to keep short-term rates negative.

Anticipation of better growth has drawn foreign money into Japanese stocks and driven yen bond yields higher. It has also put the spotlight on the $2.4 trillion of foreign debt held collectively by Japan’s life insurance companies, pension funds, banks, and trust firms and how much of those investment flows will return home.

However, these holdings earn yen investors upwards of 5%, so investors may barely react if the BOJ raises its rates by 10 or 20 basis points, according to analysts.

“I honestly don’t think it will have a big impact on flows,” says Alex Etra, a senior strategist at analytics firm Exante Data.

As per the Ministry of Finance, Japan’s foreign portfolio investments amounted to ¥628.45tn ($4.2tn) at the end of December. Out of this, half of the investments were in interest rate-sensitive debt assets and most of it was long-term.

The BOJ embarked on its quantitative and qualitative easing (QQE) in May 2013, during which time Japanese investment in foreign debt was about 89 trillion yen, nearly 60% of which belonged to pension funds, including the giant Government Pension Investment Fund or GPIF.

Etra says the country’s pension funds routinely do not hedge their overseas bond investments for currency risk, and their returns on foreign bonds are attractive, especially when translated into yen.

However, Gareth Berry, a currency, and rates strategist at Macquarie Bank, says: “I’m not a huge believer of that repatriation story. If you look at the numbers down the last 20 years, there was very little repatriation even during the GFC.”

Unlike pension funds, Japan’s big banks and life insurance firms tend to hedge their foreign bond holdings to mitigate any risk to their deposits and other yen liabilities. Flows data shows this class of investors, which includes Japan Post Bank and cooperative bank, the Norinchukin Bank, has gradually reduced foreign debt holdings since 2022.

Nomura strategist Jin Moteki says investors such as insurance firms will repatriate foreign investments only when there is sufficient yield at home in Japanese government bonds (JGBs). He estimates serious repatriation will occur only when 20-year JGB yields touch 2%, which implies a roughly 50 basis points rise in longer yields. Nomura expects the BOJ to raise the overnight rate to 0.25% by October.

“In our view, the potential repatriation that might be triggered by the end of YCC is likely to be around 45 trillion yen, at a maximum. We also expect Japanese life insurance companies to become potential main players of the repatriation,” Moteki said.

Moreover, if short-term yen rates rise just as the Fed starts cutting its rates, hedging costs would fall, making FX-hedged investments in U.S. Treasuries more appealing.

Japan Post Bank, Norinchukin, and GPIF did not immediately reply to Reuters’ requests for comments on their investment plans.

The implications of the BOJ exiting negative rates on the murkier world of FX carry trades depend heavily on the signals the BOJ sends on the trajectory for rates, rather than just the first hike.

Investors have been using the yen as the preferred currency for funding trades for many years. In these trades, investors borrow yen at zero cost and exchange it for dollars, which have a higher yield. These trades are short-term and generate significant profits. However, they are also highly sensitive to even small fluctuations in interest and exchange rates.

A 3-month dollar-yen carry trade earned 7% annualized in December but now earns only 5% because both the yen and Japanese yields have risen.

There is no easy way to estimate the number of such trades. Japan’s overall short-term lending to foreigners is cumulatively around $500 billion and could be a rough gauge of outstanding carry trades.

The ‘carry’ in these trades could shrink quickly if the market started pricing in higher short- and medium-term yields.

James Malcolm, a currency strategist at UBS in London, notes that a change of about 10 basis points in the interest rate gap between dollars and yen has roughly led to a 1% move in the dollar-yen rate in the past two to three years.

“Now, when you have a large carry trade built up, the risk is that modest changes cause capitulation and FX moves much further by generating its own dynamic.”

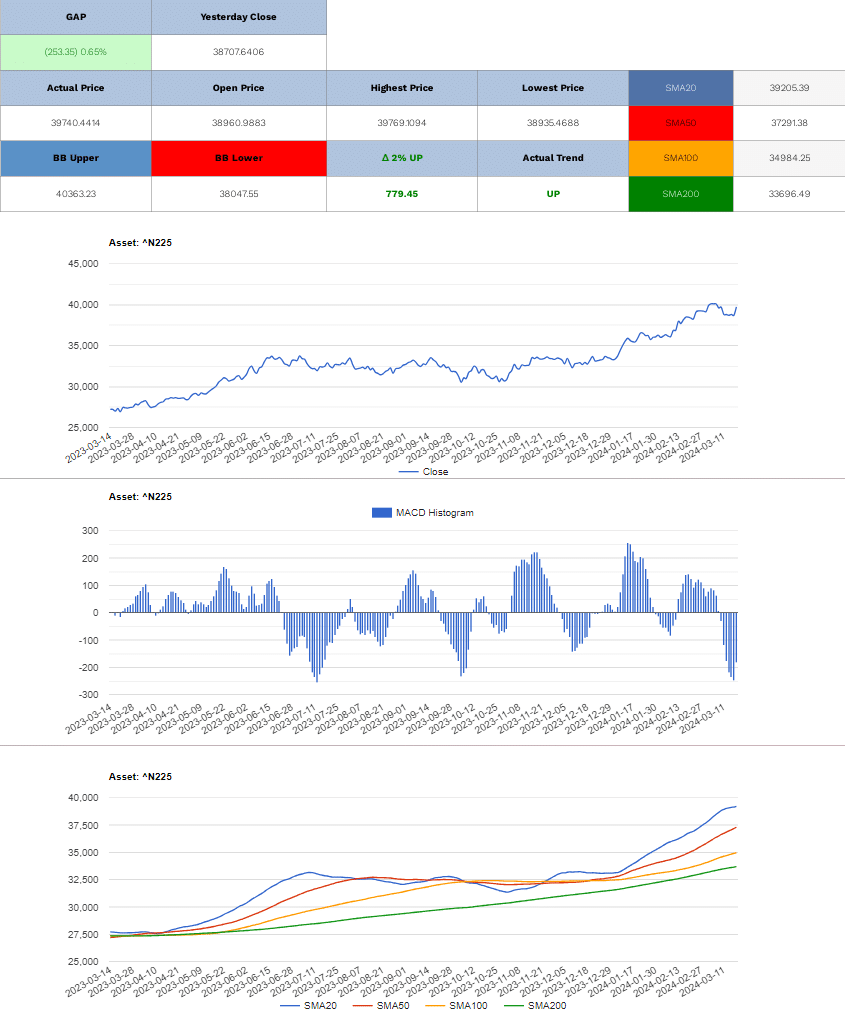

Nikkei 225 Long (Buy)

Enter At: 39946.92

T.P_1: 40437.10

T.P_2: 40947.17

T.P_3: 41395.44

T.P_4: 41817.53

T.P_5: 42292.38

T.P_6: 42925.52

T.P_7: 43505.90

S.L: 37323.39

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.