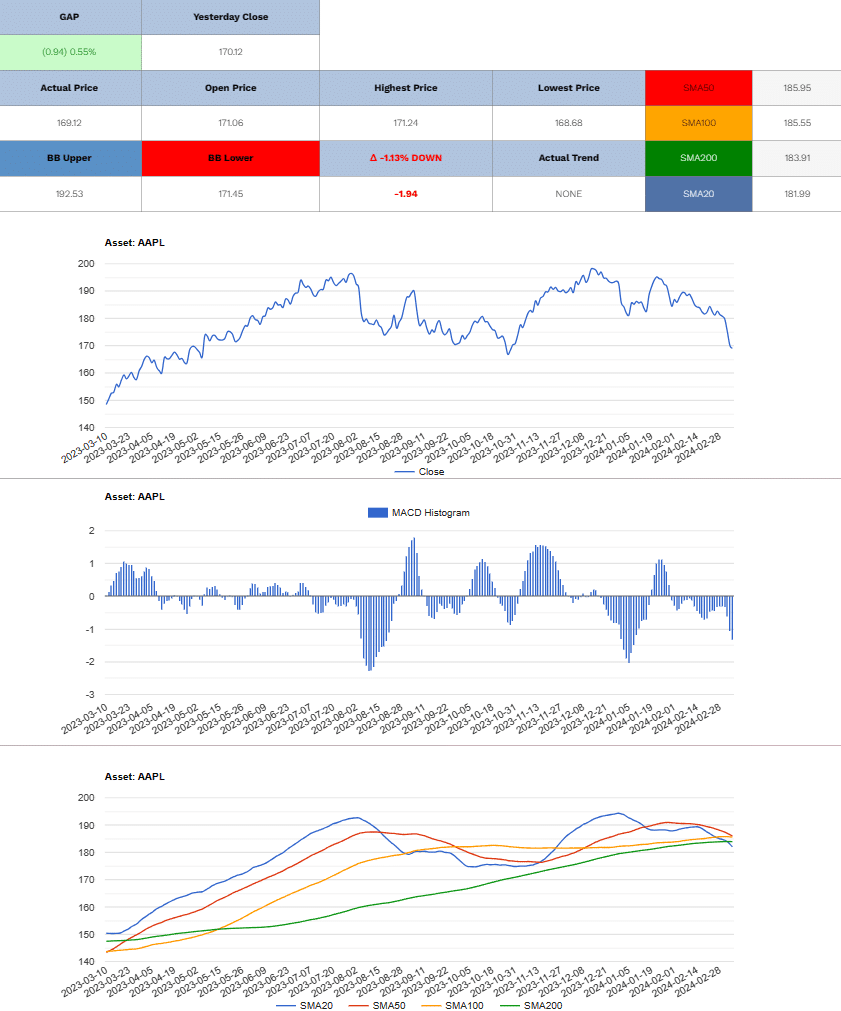

Investors are closely monitoring Apple Inc.’s (AAPL) stock performance as it continues its downward trend, dipping below the crucial $170 mark in Wednesday’s trading. With concerns over the iPhone maker’s shares hitting new lows, speculation arises about whether the decline is nearing a bottom.

Recent Performance: A Cause for Concern

On Wednesday, Apple stock recorded a 0.3% decrease, in stark contrast to the 0.8% gains witnessed by the S&P 500 and Nasdaq Composite. If this downward trajectory persists, it would mark the sixth consecutive day of losses, resulting in a cumulative decline of 7.3% over this period. Year-to-date, Apple shares are down 12%, trailing the Nasdaq by approximately 18 percentage points.

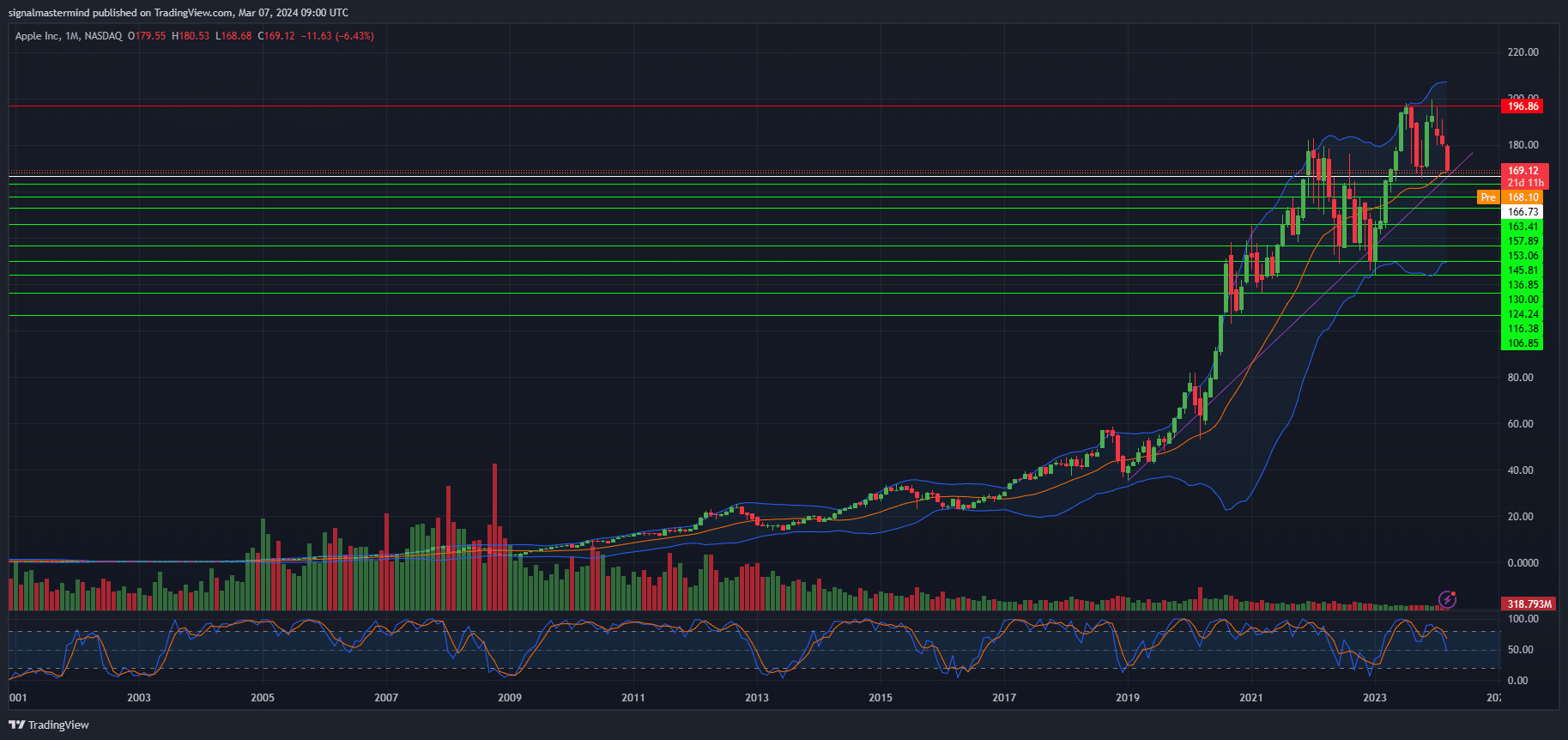

Technical Analysis and Support Levels

According to Fairlead Strategies founder and market technician Katie Stockton, Apple has broken down below the support levels of $179 to $180, indicating a bearish short-term development. The $170 level now becomes a critical threshold, as breaching it could lead to a more prolonged setback for the stock. Stockton identifies secondary support at approximately $161.

Frank Cappelleri, founder of CappThesis, and John Roque, senior managing director at 22V Research, also echo concerns about further declines. Both identify support levels around $165, and Roque warns that a breach of this level could see Apple stock dropping to $130, levels not seen since 2021.

Analysts’ Outlook and Contrarian Views

Despite the current downturn, Wall Street analysts maintain an average price target for Apple shares at about $200, reflecting an 18% potential upside from recent levels. Jefferies’ William Beavington notes that Apple is currently the most oversold it has been relative to the QQQ exchange-traded fund since 2018. He suggests that the intense negativity might eventually lead to a rebound.

Market Sentiment and Oversold Conditions

Apple’s recent struggles have not gone unnoticed, with analysts describing the stock as the most oversold in years. The company has faced challenges in 2024, including concerns about iPhone sales in China and a fine from the European Union. The stock has fallen 14% from a recent peak, erasing over $200 billion in market capitalization.

Michael Toomey, head of TMT trading at Jefferies, points out that the negativity surrounding Apple seems excessive. Jefferies’ analysis of the relative strength index indicates that Apple is the most oversold it has been compared to the QQQ ETF since early 2018.

Options Market and Future Outlook

Despite the recent selloff, options traders appear relatively optimistic, showing few signs of fear. Implied volatility for three-month options has increased from recent lows but remains within the middle range for the past year. The put skew, measuring the premium for protection against a decline, is holding near a two-year low, reflecting broader optimism about major technology stocks.

In conclusion, although Apple is facing significant technical hurdles and challenges, oversold conditions and contrarian views suggest its potential for a rebound. It is advised for investors to closely monitor market sentiment and key support levels in the coming days.

Apple Short (Sell)

Enter At: 166.73

T.P_1: 163.41

T.P_2: 157.89

T.P_3: 153.06

T.P_4: 145.81

T.P_5: 136.85

T.P_6: 130

T.P_7: 124.24

T.P_8: 116.38

T.P_9: 106.85

S.L: 196.86

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.