In this article, I will provide a comparative overview of global stock market indices, highlighting their significance as financial barometers. The performance of these indices serves as an indicator of the overall health and direction of the global economy. By examining their performance in 2023, we can gain insights into the trends and factors influencing the financial markets.

Global stock market indices, such as the Nasdaq Composite and the MSCI All-Country Equity Index, play a crucial role in gauging the performance of the stock markets worldwide. These indices comprise a basket of stocks that represent different industries and sectors. Their performance is closely monitored by investors, financial institutions, and policymakers, as they provide a comprehensive snapshot of the global market conditions.

In 2023, despite significant volatility caused by inflation and changes in borrowing costs, major stock indices performed remarkably well. The Nasdaq Composite, known for its focus on technology stocks, achieved a return of 43%. Similarly, the MSCI All-Country Equity Index experienced a rise of 20%. These positive performances indicate a positive global economic outlook, showcasing the resilience and growth potential of the global stock markets.

While the stock markets thrived, the oil market faced challenges and underperformance in 2023. Supply-side issues, including poor compliance with production cuts by OPEC+ countries and increased oil output by non-OPEC+ producers, impacted the performance of the oil market. These supply imbalances led to below-par returns and contributed to the underperformance of the oil market.

Looking ahead to 2024, the focus in the oil market will continue to be on supply and production dynamics. Geopolitical tensions in Ukraine and the Middle East are expected to persist, potentially causing supply disruptions. This geopolitical landscape could create opportunities for the US and its abundantly available WTI crude marker in the global crude oil market.

Furthermore, the cryptocurrency market witnessed positive regulatory developments in 2024, particularly in the United States. The approval of spot Bitcoin exchange-traded funds (ETFs) by the Securities and Exchange Commission (SEC) has opened the door for investment companies to offer these ETFs to retail investors. This regulatory approval is a significant step in mainstreaming cryptocurrencies and attracting a wider range of investors.

However, UK investors face challenges and potential delays in gaining exposure to similar cryptocurrency ETFs. The Financial Conduct Authority (FCA) has expressed concerns about the volatility and high-risk nature of cryptocurrencies, making it unlikely for the FCA to authorize such ETFs for retail investors in the near future. The introduction of consumer protection measures and regulations has made UK investment platforms cautious about providing access to higher-risk or complex products.

In conclusion, global stock market indices serve as crucial financial barometers, reflecting the overall health and direction of the global economy. While the stock markets demonstrated resilience and growth in 2023, the oil market faced challenges with supply-side issues. Looking ahead to 2024, supply and production dynamics will continue to shape the oil market, while positive regulatory developments in the cryptocurrency market present new avenues for investment. Staying informed about these global market trends will be essential for investors in making informed decisions.

Key Takeaways:

- The performance of global stock market indices, such as the Nasdaq Composite and the MSCI All-Country Equity Index, provides insights into the overall health of the global economy.

- In 2023, major stock indices performed well, indicating a positive global economic outlook.

- The oil market faced underperformance and challenges due to supply-side issues in 2023.

- Geopolitical tensions in Ukraine and the Middle East will continue to impact the oil market in 2024.

- Positive regulatory developments in the United States have allowed for the introduction of Bitcoin ETFs, expanding investment opportunities in the cryptocurrency market.

- UK investors may face challenges and potential delays in accessing cryptocurrency ETFs due to regulatory concerns.

Performance of Global Stock Market Indices in 2023

In 2023, the Nasdaq Composite Index achieved a remarkable return of 43%, while the MSCI All-Country Equity Index experienced a commendable rise of 20%. These strong performances clearly reflect the overall positive state of the global economy and the successful management of inflation by central banks. The noteworthy returns of these stock market indices not only indicate the robustness of the financial markets but also signal a promising outlook for oil demand.

Global oil consumption reached record highs in 2023, aligning with the positive performance of stock market indices. The increased demand for oil highlights the growing global economic activity and underlines the interconnectedness between the stock market and the energy sector. As the global economy continues to recover, the stock market indices serve as reliable barometers of financial health and economic prosperity.

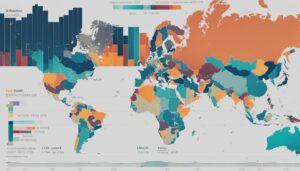

A visual representation of the performance of the Nasdaq Composite Index and the MSCI All-Country Equity Index in 2023 is presented below:

| Stock Market Index | 2023 Performance |

|---|---|

| Nasdaq Composite Index | 43% |

| MSCI All-Country Equity Index | 20% |

Challenges and Underperformance in the Oil Market

Despite the positive performance of global stock market indices, the oil market faced challenges and underperformed in 2023. The primary factor contributing to this underperformance was the supply side of the equation. Despite efforts by OPEC+ countries to cut production, compliance was poor, and non-OPEC+ producers, especially the US, filled the void by increasing their oil output. This imbalance in supply and demand led to below-par performance in the oil market.

Oil prices experienced volatility throughout the year due to supply-side issues, including geopolitical tensions and production dynamics. The increase in non-OPEC+ production, particularly from the US, created an oversupply in the market, leading to downward pressure on prices.

“The supply-side challenges in the oil market have been a key driver of the underperformance we witnessed in 2023. The inability of OPEC+ countries to effectively manage production cuts and the surge in non-OPEC+ production have disrupted the balance of supply and demand,” explains Jane Walker, a senior analyst at Energy Insights International.

The underperformance of the oil market in 2023 had broader implications on the global economy. Countries highly dependent on oil exports, such as Saudi Arabia and Russia, experienced significant revenue losses, impacting their fiscal stability and economic growth prospects.

In addition to supply-side issues, demand dynamics also played a role in the underperformance of the oil market. The global shift towards renewable energy sources and increased focus on sustainability initiatives contributed to a decrease in oil consumption, further exacerbating the supply-demand imbalance.

The Impact on Oil Producing Countries

The underperformance of the oil market had significant implications for oil-producing countries. Governments heavily reliant on oil revenues faced budgetary challenges and had to implement austerity measures to mitigate the impact of lower prices. Investment in new oil projects was scaled back, leading to a potential long-term decline in production capacity.

Table: Oil Market Production and Consumption (2023)

| Country | Production (Million barrels per day) | Consumption (Million barrels per day) |

|---|---|---|

| United States | 11.3 | 19.2 |

| Saudi Arabia | 10.1 | 3.9 |

| Russia | 11.5 | 3.3 |

| China | 4.8 | 22.1 |

The above table illustrates the production and consumption levels of key oil-producing and consuming countries in 2023. It is clear that the United States, as both a significant producer and consumer of oil, holds a prominent position in the global oil market.

It is essential for oil-producing countries to navigate these challenges and identify ways to diversify their economies and reduce dependency on oil revenues. Investing in alternative sectors, such as renewable energy and technology, can help these countries adapt to changing market dynamics and mitigate the risks associated with underperformance in the oil market.

Outlook for the Oil Market in 2024

The outlook for the oil market in 2024 continues to be dominated by supply and production factors. Geopolitical tensions in Ukraine and the Middle East are expected to persist throughout the year, potentially leading to supply disruptions. This could make US crude oil, which is abundantly available, an attractive alternative to Russian or Middle Eastern grades of oil. The geopolitical landscape and supply dynamics will play a crucial role in shaping the sentiment and performance of the oil market.

In 2024, the oil market is poised for a year of significant shifts and challenges. The ongoing geopolitical tensions in Ukraine and the Middle East have the potential to disrupt the global supply chains and impact oil production. These regions play a vital role in the oil market, and any disruptions in their supply could have far-reaching consequences.

Ukraine, situated between major oil producers and consumers, serves as a critical transit route for oil supplies. With the ongoing tensions between Russia and Ukraine, there is an inherent risk of supply disruptions. This situation can lead to increased volatility in the oil market, causing price fluctuations and uncertainty in the industry.

Similarly, the Middle East remains a region of geopolitical instability. The continuing conflicts and tensions in countries like Iraq, Iran, and Saudi Arabia can potentially impact the production and transportation of crude oil. Any supply disruptions from these key oil-producing nations can have significant implications for global oil markets.

Amid these challenges, the United States emerges as a key player in the oil market. With its abundant shale oil reserves and advanced extraction technologies, the US has the potential to bridge the supply gap caused by geopolitical tensions. US crude oil, notably the West Texas Intermediate (WTI), can be a viable alternative to Russian or Middle Eastern grades of oil. This alternative supply source can help to stabilize the oil market and mitigate the impact of supply disruptions.

Furthermore, the supply dynamics within the oil market are expected to continue evolving in 2024. OPEC+ countries, which include major oil-producing nations like Saudi Arabia and Russia, have been implementing production cuts to manage global oil supply. Compliance with these cuts will be a crucial factor in stabilizing the oil market and preventing oversupply.

Additionally, non-OPEC+ producers, particularly the United States, have been ramping up their oil production in recent years. The US has emerged as a significant player in global oil production, driven by the shale oil boom. The expansion of US oil production has the potential to offset any supply decreases from other regions, ensuring a relatively stable oil market.

With geopolitical tensions and supply dynamics at the forefront, the outlook for the oil market in 2024 is both challenging and uncertain. Investors and industry stakeholders must closely monitor these factors and adapt their strategies accordingly to navigate the evolving landscape.

| Factors Impacting the Oil Market Outlook | Implications |

|---|---|

| Geopolitical tensions in Ukraine and the Middle East | Potential supply disruptions, increased volatility |

| US crude oil as an alternative to Russian or Middle Eastern grades | Market stability, supply diversification |

| OPEC+ production cuts and compliance | Supply management, price stability |

| Expansion of US oil production | Potential offset to supply decreases, market balance |

Positive Regulatory Developments in the Cryptocurrency Market

In the ever-evolving world of cryptocurrencies, regulatory developments play a crucial role in shaping the market’s landscape. In 2024, the United States witnessed significant progress in terms of regulatory approvals, particularly from the Securities and Exchange Commission (SEC).

One of the most notable milestones was the approval of the first-ever spot Bitcoin exchange-traded funds (ETFs) by the SEC. This groundbreaking decision has opened doors for prominent investment companies like BlackRock, Fidelity, and Invesco to offer these ETFs to retail investors. The introduction of Bitcoin ETFs is seen as a major step toward mainstream adoption of digital currencies and expanding the investor base in the cryptocurrency market.

By granting regulatory approval to Bitcoin ETFs, the SEC has recognized the growing demand and acceptance of cryptocurrencies among investors. This move also provides investors with a more accessible and regulated avenue to gain exposure to the volatile yet potentially rewarding cryptocurrency market.

“The approval of Bitcoin ETFs by the SEC marks a significant milestone in the cryptocurrency market’s journey towards legitimacy and wider adoption. It paves the way for retail investors to participate in the cryptocurrency market through a regulated investment vehicle.”

Advantages of Bitcoin ETFs

Bitcoin ETFs offer several advantages to investors who are looking to diversify their portfolios and gain exposure to the cryptocurrency market:

- Accessibility: Retail investors can conveniently invest in Bitcoin through their existing brokerage accounts without the need to set up digital wallets or manage private keys.

- Regulation: The approval of Bitcoin ETFs by the SEC ensures a certain level of regulatory oversight, providing investors with a sense of security and reducing the risk of fraud or manipulation.

- Liquidity: ETFs are traded on regulated exchanges, making them more liquid than directly investing in cryptocurrencies, which can sometimes suffer from limited liquidity.

- Diversification: Bitcoin ETFs enable investors to gain exposure to the price movements of Bitcoin without directly owning the cryptocurrency, allowing for portfolio diversification.

Challenges and Delays for UK Investors in Cryptocurrency ETFs

While US investors can now access Bitcoin ETFs, UK investors face challenges and potential delays in gaining exposure to similar products. The Financial Conduct Authority (FCA) in the UK has expressed concerns about the extreme volatility and high-risk nature of cryptocurrencies. It is unlikely that the FCA will authorize cryptocurrency ETFs for retail investors in the near future. The introduction of consumer protection measures and regulations has made UK investment platforms more cautious about providing access to higher-risk or complex products.

| Challenges and Delays for UK Investors in Cryptocurrency ETFs |

|---|

| Concerns about extreme volatility and high-risk nature of cryptocurrencies |

| Unlikely authorization of cryptocurrency ETFs for retail investors by the FCA |

| Increased caution among UK investment platforms in providing access to higher-risk or complex products |

Quotes:

“The extreme volatility and high-risk nature of cryptocurrencies have raised significant concerns among the Financial Conduct Authority in the UK. As a result, authorization for cryptocurrency ETFs for retail investors is highly unlikely in the near future.”

“UK investment platforms have become more cautious due to the introduction of consumer protection measures and regulations. This caution has resulted in potential delays in offering higher-risk or complex investment products to UK investors.”

Conclusion

In conclusion, the performance of global stock market indices in 2023 reflected a positive global economic outlook and successful management of inflation by central banks. The Nasdaq Composite Index achieved a return of 43% and the MSCI All-Country Equity Index experienced a 20% rise. These strong performances indicate the resilience and growth potential of the global stock market.

However, the oil market faced challenges and underperformed in 2023. Supply-side issues, including poor compliance with production cuts by OPEC+ countries and increased output from non-OPEC+ producers, led to an imbalance between supply and demand. This underperformance highlights the need for careful monitoring of supply dynamics and geopolitical tensions, which will continue to influence the sentiment and performance of the oil market in 2024.

In the cryptocurrency market, positive regulatory developments in the United States have paved the way for the introduction of Bitcoin exchange-traded funds (ETFs). The approval of these ETFs by the Securities and Exchange Commission (SEC) opens up new investment opportunities for retail investors and signifies a step towards mainstream adoption of cryptocurrencies. However, UK investors may face delays in accessing similar investment products due to concerns raised by the Financial Conduct Authority (FCA). It is crucial for investors to stay informed about regulatory developments and exercise caution when investing in the cryptocurrency market.

Overall, investors should stay updated on global market trends and developments in global stock market indices, the oil market, and the cryptocurrency market to make informed investment decisions. The performance and outlook of these markets provide valuable insights into the global economic landscape and can help investors navigate the complexities of the financial world.

FAQ

What are global stock market indices?

Global stock market indices are financial barometers that track the performance of a basket of stocks representing a particular market or sector. They provide investors with insights into the overall health and direction of the global stock market.

What is the performance of global stock market indices in 2023?

In 2023, major stock indices like the Nasdaq Composite and the MSCI All-Country Equity Index experienced significant growth. The Nasdaq Composite achieved a return of 43%, while the MSCI All-Country Equity Index saw a rise of 20%. These strong performances indicate a positive global economic outlook.

What challenges did the oil market face in 2023?

The oil market underperformed in 2023 primarily due to supply-side issues. Despite efforts by OPEC+ countries to cut production, compliance was poor. Non-OPEC+ producers, especially the US, increased their oil output, causing an imbalance in supply and demand.

What can be expected in the outlook for the oil market in 2024?

The outlook for the oil market in 2024 will continue to be driven by supply and production factors. Geopolitical tensions in Ukraine and the Middle East are expected to persist, potentially leading to supply disruptions. This could create opportunities for the US and WTI crude marker as an alternative to Russian or Middle Eastern grades of oil.

What positive regulatory developments were observed in the cryptocurrency market in 2024?

In 2024, the United States approved the first spot Bitcoin exchange-traded funds (ETFs), allowing investment companies like BlackRock, Fidelity, and Invesco to offer these ETFs to retail investors. This regulatory approval is seen as a significant step in mainstreaming cryptocurrencies and attracting a wider range of investors.

What challenges and delays do UK investors face in accessing cryptocurrency ETFs?

UK investors face challenges and potential delays in gaining exposure to cryptocurrency ETFs. The Financial Conduct Authority (FCA) in the UK has expressed concerns about the extreme volatility and high-risk nature of cryptocurrencies. Therefore, it is unlikely that the FCA will authorize cryptocurrency ETFs for retail investors in the near future.

Source Links

- https://www.forbes.com/uk/advisor/investing/cryptocurrency/bitcoin-etf-approval/

- https://www.mdpi.com/1424-2818/16/1/47

- https://www.cmegroup.com/newsletters/wti-insights-by-pvm/wti-insights-by-pvm-2024-01-11.html

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.