The Canadian Dollar (CAD) depreciated against the Pound Sterling (GBP) today, reaching a fresh six-month low. This occurred despite the release of a stronger-than-expected Canadian jobs report. The seemingly paradoxical market behavior can be attributed to the interconnectedness of the Canadian and American economies, particularly regarding monetary policy decisions.

Canadian Jobs Report Exceeds Expectations, But CAD Falters

Statistics Canada reported a positive surprise in its February jobs data. Employment increased by a notable 41,000 positions, surpassing market forecasts of 20,000. The unemployment rate held steady at 5.8%. However, this positive domestic data failed to bolster the CAD.

CAD Trades in Tandem with USD

The CAD frequently exhibits a close correlation with the USD due to the substantial economic and financial ties between the two North American nations. The recent depreciation of the CAD can be primarily traced back to the ongoing selloff in the USD.

US Jobs Report Hints at Potential Rate Cuts by the Fed

The United States also released its February jobs report, revealing robust employment growth. However, a key differentiating factor emerged – a significant deceleration in wage growth. This signals a potential tempering of the US labor market, potentially influencing the Federal Reserve to consider interest rate cuts as early as June.

Market Anticipates Aligned Rate Cuts in US and Canada

Given the intimate connection between the Canadian and US economies, a potential Fed rate cut could prompt the Bank of Canada to follow suit. This market expectation is exerting downward pressure on the CAD.

Positive Job Growth, But Rate Cut Not Imminent for Bank of Canada

While the Canadian jobs report painted a positive picture, a more granular analysis is necessary. The employment gains stemmed primarily from full-time positions, with a corresponding decrease in part-time work. Additionally, wage growth exhibited signs of moderation.

Analysts suggest that these trends, coupled with the overall trajectory of the labor market, indicate a gradual easing but not an immediate justification for a rate cut by the Bank of Canada. Most forecasts anticipate the Bank of Canada’s first rate cut to occur in June.

In Conclusion

The CAD’s depreciation today is less a response to Canada’s strong domestic data and more a reflection of broader USD weakness and the potential for forthcoming Federal Reserve policy changes. Nonetheless, the positive Canadian jobs data, particularly the shift towards full-time employment, signifies a robust labor market with the potential to influence future monetary policy adjustments by the Bank of Canada.

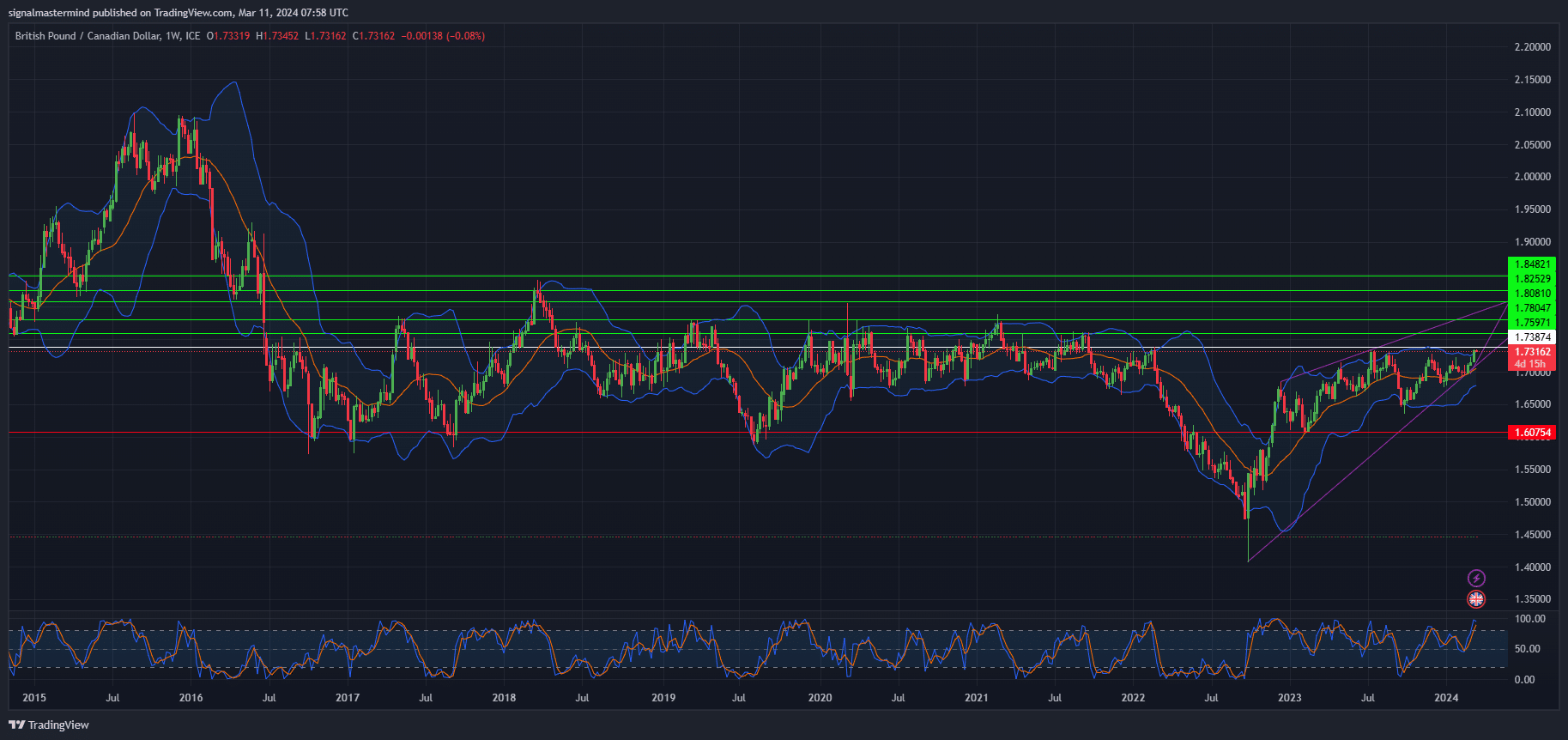

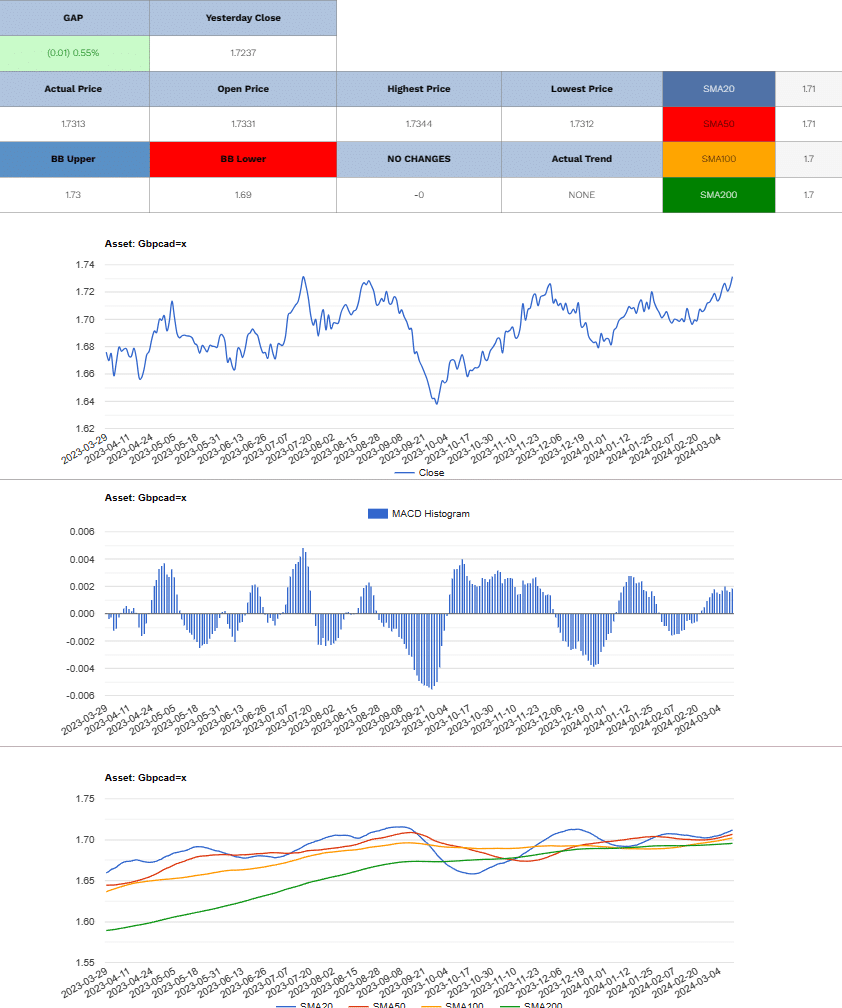

GBP/CAD Lomg (Buy)

Enter At: 1.73874

T.P_1: 1.75971

T.P_2: 1.78047

T.P_3: 1.80810

T.P_4: 1.82529

T.P_5: 1.84821

S.L: 1.60754

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.